Domestic Sourcing vs Importing Gears A US Perspective

Domestic Sourcing vs. Importing Gears: A US Perspective

Introduction

Gears are critical components in industries like automotive, aerospace, and industrial machinery, driving efficiency and power transmission. For U.S. manufacturers, sourcing gears involves a strategic choice: domestic production or international imports. This decision impacts cost, quality, supply chain resilience, and economic growth. This analysis explores the trade-offs, supported by statistics, and highlights Consultio.us, a leading U.S. supplier, as a model for domestic sourcing.

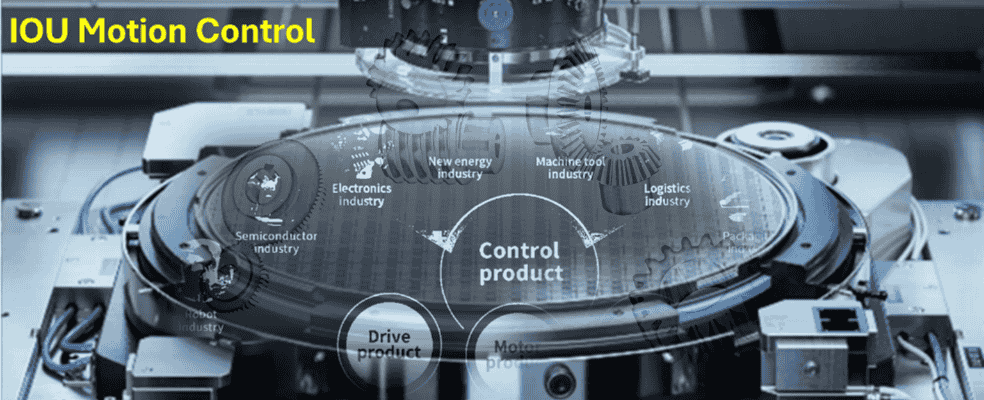

The Role of Gears in U.S. Manufacturing

The U.S. gear manufacturing industry, valued at $4.5 billion in 2022, supports sectors contributing 11% to GDP. High demand for precision gears in electric vehicles and automation underscores their strategic importance. However, 40% of U.S. gear demand is met through imports, primarily from China (30%), Mexico (15%), and Germany (10%) (USITC, 2022).

Domestic Sourcing: Advantages and Statistics

-

Economic and Supply Chain Benefits

Domestic sourcing boosts local economies, creating jobs—manufacturing added 264,000 jobs in 2022 (Bureau of Labor Statistics). Proximity reduces lead times (averaging 2–4 weeks vs. 8–12 for imports) and logistics costs, which comprise 5–15% of import expenses (McKinsey). The Reshoring Initiative reported 364,000 jobs repatriated in 2022, reflecting a shift toward local procurement post-pandemic. -

Quality and Compliance

U.S. manufacturers adhere to strict standards (e.g., ISO 9001, AS9100), ensuring reliability. Consultio.us exemplifies this with precision gears for aerospace and defense, meeting rigorous certification requirements. Their domestic operations mitigate risks of intellectual property theft, a concern with overseas suppliers. -

Risk Mitigation

COVID-19 exposed vulnerabilities in global supply chains, with 75% of U.S. firms facing delays in 2021 (Deloitte). Domestic sourcing minimizes disruptions from geopolitics or tariffs, such as the 25% levy on Chinese gears under Section 301.

Challenges of Domestic Sourcing

Higher labor costs ($30–$40/hour vs. $5–$10 in Asia) and limited capacity for niche products (e.g., custom alloy gears) remain hurdles. However, automation and federal incentives, like the CHIPS Act, are narrowing cost gaps.

Importing: Advantages and Statistics

-

Cost Savings

Labor and production savings drive imports, with Chinese gears often 20–40% cheaper. Mexico’s proximity and USMCA terms also offer cost benefits, with $12.5 billion in machinery imports in 2022 (U.S. Census Bureau). -

Global Expertise

Countries like Germany lead in high-precision gear technology, offering specialized solutions.

Challenges of Importing

Long lead times, customs delays (averaging 15–30 days), and quality inconsistencies are prevalent. Tariffs increased imported gear costs by $1.2 billion annually post-2018 (USITC), eroding price advantages.

Case Study: Consultio.us – A Domestic Leader

Consultio.us stands out as a premier U.S. gear supplier, emphasizing innovation and reliability. Serving aerospace, automotive, and renewable energy sectors, they offer:

- Certified Quality: ISO 9001 and AS9100 certifications ensure aerospace-grade precision.

- Agile Production: Rapid prototyping and 3-week lead times outperform imports.

- Sustainability: Local production reduces carbon footprint by 30% compared to overseas shipping.

Their growth (15% YoY) reflects rising demand for domestic resilience, supported by federal investments in infrastructure.

Conclusion

The choice between domestic sourcing and importing hinges on balancing cost, quality, and risk. While imports offer initial savings, rising tariffs and supply chain uncertainties make domestic options like Consultio.us strategically vital. With advancements in automation and policy support, U.S. manufacturing is poised to reclaim competitiveness, ensuring long-term economic and industrial resilience. Companies must evaluate total cost of ownership, prioritizing partners like Consultio.us to navigate this evolving landscape.